Gold, often seen as an analog for sound money, rose 1% on Monday to set another record high and bring its 2025 gain to 43%.

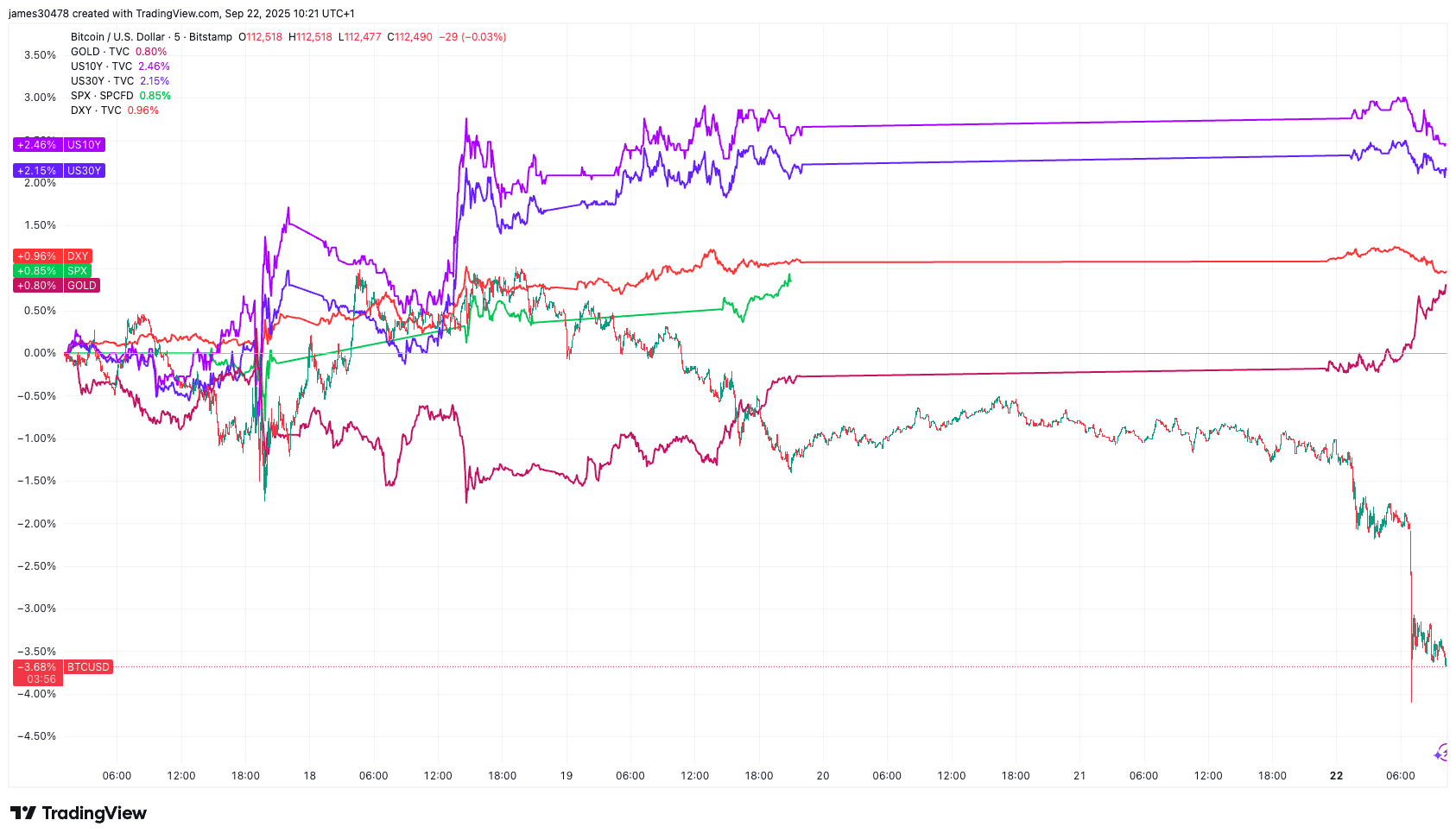

The metal, now trading at $3,721, advanced about an hour after bitcoin , seen by some proponents as a digital form of sound money, posted a 24-hour drop of 3% that cut its price to $112,000 and its year-to-date gain to 17%. The timing suggests the possibility that profits from bitcoin liquidations rotated into gold.

The two assets rarely move in tandem, though there are occasional periods when both rise or fall simultaneously, often with a short lag. This time, the divergence is stronger.

Gold is not the only metal attracting flows. Silver gained 1.5% on Monday to approach $44, its third-highest level since 1975, and is now up more than 50% year to date.

Notably, since the Federal Reserve cut interest rates by 25 bps on Sept. 17, both gold and the S&P 500 are up about 1%. At the same time, U.S. treasury yields have risen, with the U.S. 10-year at 4.125% (up 2.5%) and the U.S. 30-year at 4.7% (up 2%).

The dollar strengthened, with the DXY index adding 1% to 97.5. A stronger dollar typically puts pressure on risk assets, and bitcoin has dropped over 3.5% since the Fed’s move.