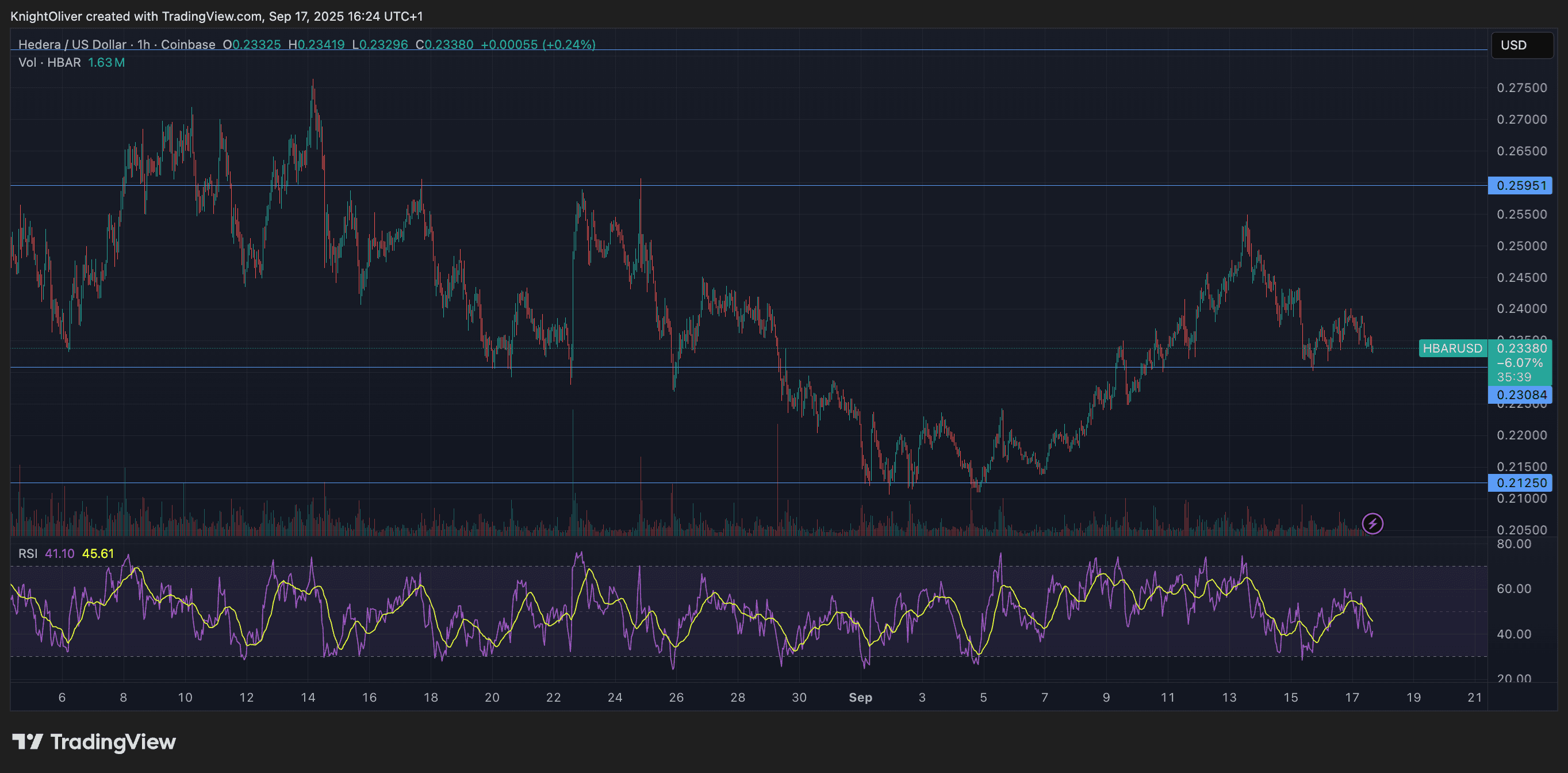

HBAR spent much of the past 23 hours locked in a narrow range, oscillating between $0.23 and $0.24 in what amounted to just 2% volatility. The token briefly touched session highs at $0.24 on Sept. 16 around 18:00 UTC before sliding lower, ultimately finding repeated support near $0.23. Multiple rebound attempts from that level throughout Sept. 17’s morning trading hinted at a potential price floor, though conviction remained limited.

Market activity tapered alongside the price drift. Trading volumes fell steadily after an early spike, underscoring weakening participation and suggesting that bullish momentum has largely faded. The constrained range and muted volatility reinforced the impression of indecision, with buyers and sellers unwilling to press for a breakout.

The final hour of the observed period offered a sharper display of market sentiment. At 13:33 UTC on Sept. 17, HBAR sold off abruptly from $0.24 to $0.23, accompanied by an outsized 2.56 million in volume just three minutes later. Yet the coin staged a measured recovery, climbing back to end near session highs, encapsulating the day’s push and pull between sellers and opportunistic dip buyers.

Overall, HBAR slipped 1% across the 23-hour window. While the establishment of support around $0.23 provides some stability, declining volumes and sustained downward pressure leave the market vulnerable. The swift sell-off and subsequent rebound illustrate the uncertainty still shaping HBAR’s outlook, with bearish sentiment prevailing but tempered by signs of technical resilience.

Technical Indicators Assessment

- Price action demonstrated consolidation within a 2% range between $0.23-$0.24 resistance and support thresholds.

- Volume contracted from 45.7 million to 4.7 million tokens indicating deteriorating market participation.

- Multiple rebounds at $0.23 support level suggest potential price floor establishment.

- Acute sell-off at 13:33 followed by recovery indicates volatile intraday sentiment fluctuations.

Disclaimer:Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence toour standards. For more information, seeCoinDesk’s full AI Policy.