Bitcoin’s (BTC) offshoot bitcoin cash has rallied 7% to $647 in the past 24 hours, revisiting valuations last seen in April 2024, according to data source CoinDesk.

The rally follows a period of extreme bearish market sentiment for the token, according to data tracking platform Santiment.

“Historically, prices move in the opposite direction of the crowd’s expectations. So, implementing a strategy of buying when the crowd is fearful and selling when the crowd gets greedy continues to work extremely well for most altcoins,” Santiment said on X, explaining BCH’s upswing.

The token’s rally aligns with the broader risk-on sentiment sparked by Wednesday’s Fed rate cut and market expectations for continued liquidity easing in the coming months. Several tokens, including DOT, SUI, JUP, and NEAR, have seen similar gains in the past 24 hours, while smaller coins like PENGU have led the charge with impressive double-digit increases.

Possibly greasing the Fed-led bullish market sentiment is the Securities and Exchange Commission’s (SEC) decision to approve generic listing standards for commodity and crypto ETFs without undergoing individual reviews for each product. This move is expected to speed up the introduction of new products tied to a variety of tokens in the coming months.

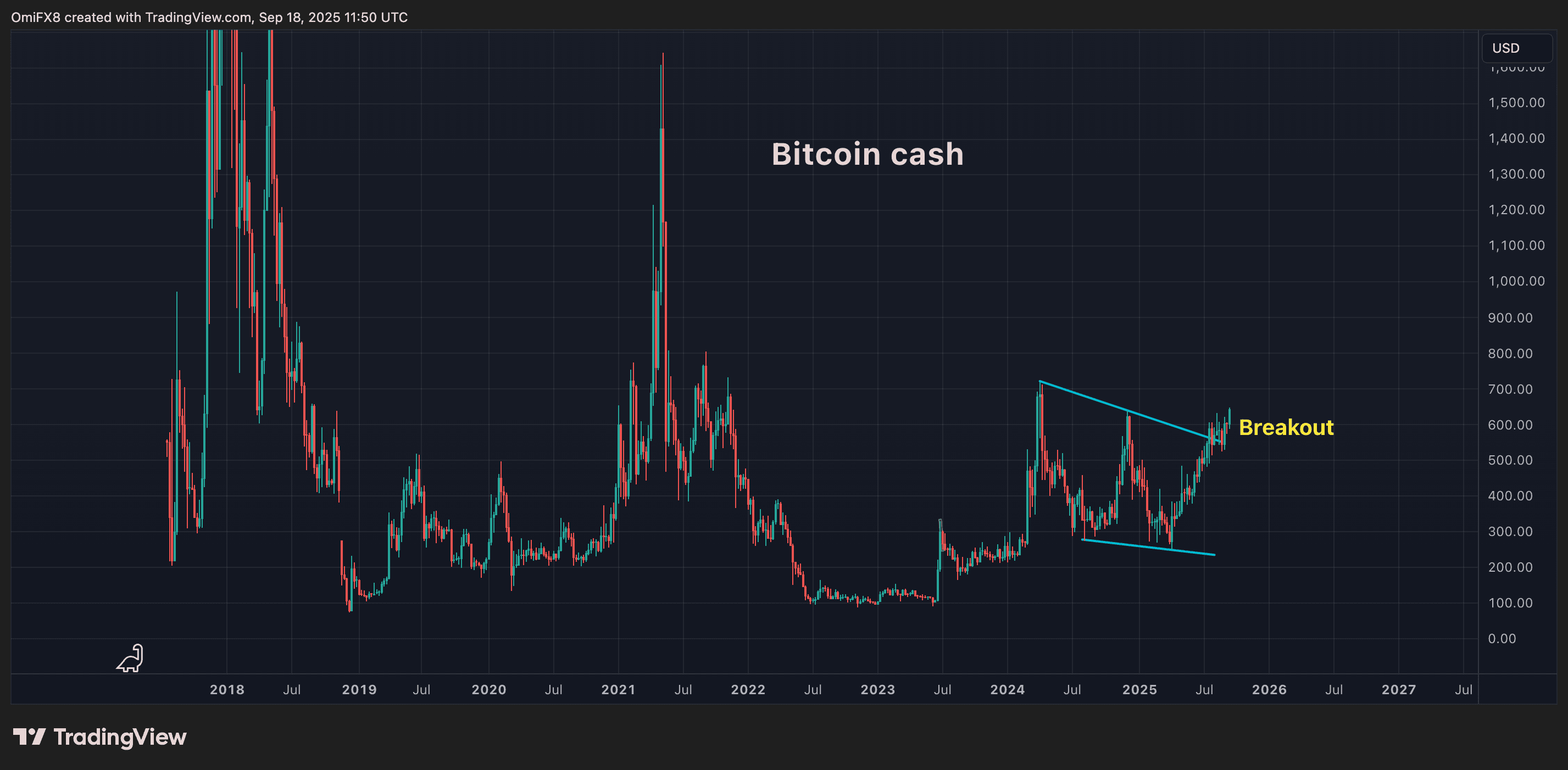

BCH’s recent move builds on the bullish breakout confirmed two months ago. In July, its price surged above the upper boundary of a channel pattern formed by trendlines connecting highs from April and December 2024, and lows from August 2024 and April 2025.

This breakout from a prolonged period of consolidation suggests that selling pressure has been absorbed, clearing the way for further upside. The immediate resistance to watch is the 2024 high at $719, which could be the next key hurdle for BCH to surpass.