Markets take the escalator up and elevator down goes an old Wall Street shibboleth, and crypto is following that script this week, with several days of hard-earned gains more than wiped away in Friday trade.

Nearly pushing through the $118,000 level at one point on Thursday after the Federal Reserve one day earlier trimmed interest rates for the first time this year, bitcoin has pulled back to $115,600, down 1.5% over the past 24 hours and now essentially flat over the past seven days.

Ether (ETH) has pulled back from the $4,750 area to $4,460, lower by 2.9% over the past 24 hours and now off 1.5% week-over-week.

Amid ETF excitement and growing institutional adoption, the two hottest crypto majors this week were solana and dogecoin . Both, however, have returned to flat over the last seven days, with SOL lower by 4.5% over the past 24 hours and DOGE down 6.3%.

Technical factors suggest reason for optimism

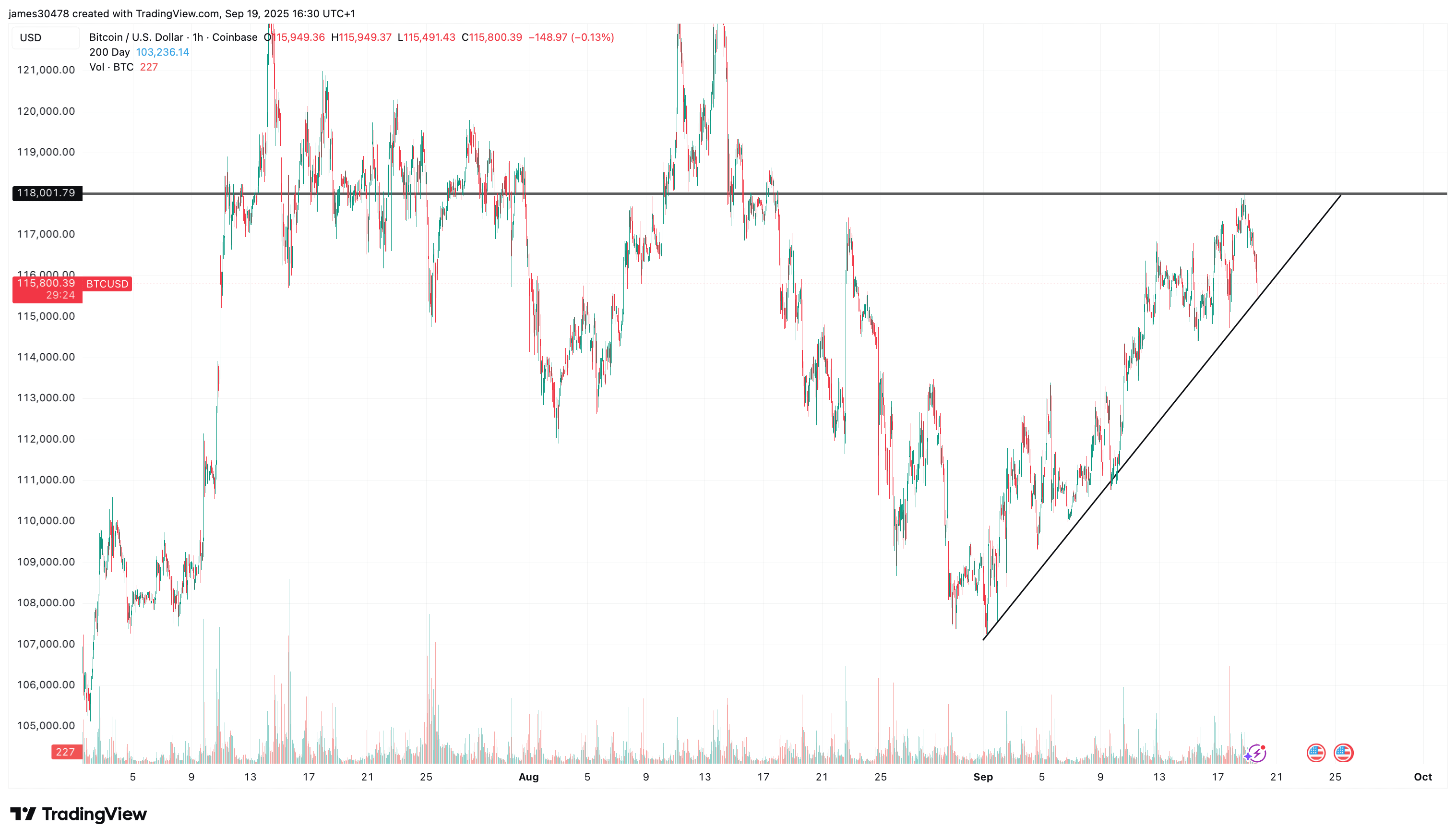

In a world where U.S. stocks have been putting in record highs on a daily basis, it may seem that bitcoin has failed to gain much ground of late. Its price action over the past few weeks, though, has formed a clear ascending triangle pattern, highlighted by a series of higher lows, while pressing against horizontal resistance near $118,000.

Each pullback since early September has found support at a rising trendline, signaling steady accumulation and a bullish bias among traders. The market is currently consolidating in the $115,700 around the rising support line.

Ascending triangles are traditionally viewed as continuation patterns, often breaking to the upside when buyers gain momentum.

For now, the higher lows keep the advantage tilted toward bulls, with traders closely watching the 118,000 dollar ceiling.